Rethinking IUL: Structure, Strategy & the Truth Behind the Product

- Damon Boyd

- Dec 28, 2025

- 4 min read

Indexed Universal Life (IUL) often gets a bad rap, but most of that reputation comes from how it's structured and sold—not from the core design of the product itself. When used thoughtfully, an IUL can provide lifelong protection while giving your money a disciplined way to grow with downside protection and potential tax advantages as part of a broader financial strategy.

| Why IULs Are Misunderstood

Many people first encounter IULs through aggressive sales pitches or confusing illustrations, which leads to skepticism and disappointment. The real issue is usually not the policy, but how it was set up—too high a premium, unrealistic expectations, or unclear explanations of how caps, floors, and costs work over time.

In reality, an IUL is a life insurance policy that combines permanent death benefit protection with the potential for cash value accumulation tied to a market index, subject to specific rules and limits. It is not a direct investment in the stock market, and index performance does not directly equal policy performance.

| Structure Is Everything

An IUL is first and foremost about protection—providing a death benefit for your loved ones. But when structured correctly, it can also become a powerful tool to help protect and grow your money over time within an insurance-based framework.

Rather than focusing on the largest possible, rigid premium, an IUL can be designed with a base level of funding that fits your situation, with the flexibility to add more over time as your circumstances and goals evolve. The appropriate base premium will differ from person to person, depending on needs, qualifications, underwriting, and overall financial strategy. Subject to underwriting, contract provisions, and IRS rules, you may have the ability to contribute additional premiums—potentially several times your base level of funding—while staying within Modified Endowment Contract (MEC) limits so the policy can retain its tax-favored status.

This kind of design aligns with how many financially sophisticated households use IUL: focus on efficiency, flexibility, and long-term strategy—not just big, inflexible premiums.

| Caps, Floors, and Protecting Your Downside

One of the most misunderstood aspects of IUL is how interest is credited to the policy. Your cash value is not invested directly in the market; instead, interest is credited based on the performance of an external index, subject to caps, floors, and other terms set by the insurer.

In a typical IUL design, the policy will have a current cap rate and a current floor rate. That means:

In strong index years, the credited interest can go up to the cap, but not above it.

In poor index years, a minimum floor rate is credited, so you are not directly exposed to market losses within the policy's crediting structure.

These values are specific to each product and contract and are determined by the issuing insurance company; they may vary among policies and can be changed in the future according to the terms of the policy. This framework aims to provide a balance: potential for upside when markets do well, plus a level of downside protection through the floor rate.

| The Incentive Problem: Why IULs Get a Bad Rap

A major reason IULs get criticized is not the product, but the incentives around it. Many agents are paid based on premium size, which can create pressure to recommend very high, inflexible premiums that benefit the salesperson more than the client.

By contrast, strategies often used by wealthier households—sometimes called "max-funded" or "maximum allowable contribution" approaches—focus on:

Keeping internal policy costs as efficient as possible relative to funding.

Contributing premiums up to, but not over, MEC limits to help preserve tax advantages.

Designing the death benefit and funding pattern around the client's goals instead of a commission target.

A structure that uses a manageable base premium with room to contribute more when appropriate reflects this kind of strategy and is meant to keep you in control of your cash flow instead of feeling locked in.

| Whole Life vs. IUL: Different Tools, Different Purposes

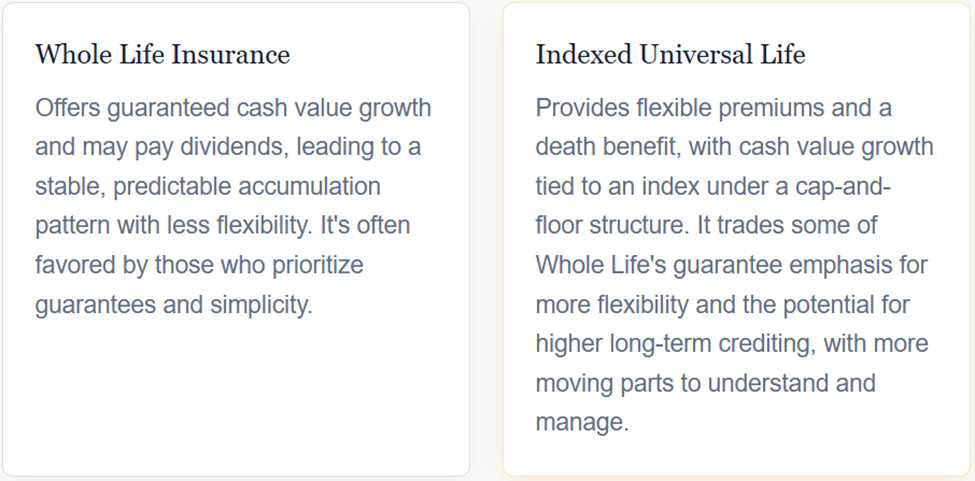

Whole Life and IUL are both forms of permanent life insurance, but they operate very differently and serve different preferences and planning styles.

Neither is inherently better; each can be appropriate depending on risk tolerance, time horizon, desired guarantees, and broader financial goals.

| A Strategy-First Approach

As a licensed financial professional, the goal is not to "sell a product," but to help design strategies that fit your needs today and keep you open to more advanced opportunities tomorrow. That includes:

Aligning the death benefit with your protection needs.

Structuring premiums to balance affordability, flexibility, and efficiency.

Considering how the policy may support future goals like tax-advantaged supplemental income, legacy planning, or coordination with other assets.

When the structure is intentional, the expectations are clear, and the policy is monitored over time, an IUL stops being a controversial buzzword and becomes what it was meant to be: a long-term, insurance-based financial tool designed around your life, your goals, and your tolerance for risk and flexibility.

Important Information & Disclosures

This content is for informational purposes only and is not intended as tax, legal, or accounting advice. Product features, caps, floors, charges, and rider availability vary by carrier and policy and are subject to change. Indexed Universal Life is not a direct investment in the stock market, and index performance does not directly represent policy performance. All guarantees are backed by the claims-paying ability of the issuing insurance company. Premium flexibility and funding ranges are subject to underwriting, contract terms, and IRS Modified Endowment Contract (MEC) rules. Clients should consult their own tax and legal professionals regarding their specific situations.

Comments